I remember that!As recently as late December, Monsanto was named “company of the year” by Forbes magazine. Last week, the company earned a different accolade from Jim Cramer, the television stock market commentator. “This may be the worst stock of 2010,” he proclaimed.

The month after Forbes did that,

Covalence did a survey that ranked Monsanto

the least ethical company in the world.

Worse than Philip Morris, Chevron, or Halliburton!

The month after Forbes did that,

Covalence did a survey that ranked Monsanto

the least ethical company in the world.

Worse than Philip Morris, Chevron, or Halliburton!

About that time we discovered Monsanto Corn Causes Liver and Kidney Damage in Rats, and that Monsanto’s GM soy causes sterility and five times higher infant mortality in hamsters.

Meanwhile, the

U.S. Department of Justice was

investigating Monsanto’s seed business. At least

seven U.S. states started their own

investigations, and later the U.S. EPA fined

Monsanto $2.5 million for selling seeds illegally in Texas counties where

they were banned.

Anyway, could all this bad news have some effect on Monsanto’s share price?

The latest blow came last week, when early returns from this year’s

harvest showed that Monsanto’s newest product, SmartStax corn, which

contains eight inserted genes, was providing yields no higher than the

company’s less expensive corn, which contains only three foreign genes.

Monsanto has already been forced to sharply cut prices on SmartStax and

on its newest soybean seeds, called Roundup Ready 2 Yield, as sales fell

below projections.

Until now, Monsanto’s main challenge has come from opponents of

genetically modified crops, who have slowed their adoption in Europe and

some other regions.

Since then we’ve learned that

Pesticides Linked to ADHD.

Specifically organophosphate pesticides.

Like Glysophate (RoundUp).

And that indicators of pesticides, including organophosphates,

are found in the urine of 95% of school children.

We already knew that

Glysophoate causes birth defects in humans.

Since then we’ve learned that

Pesticides Linked to ADHD.

Specifically organophosphate pesticides.

Like Glysophate (RoundUp).

And that indicators of pesticides, including organophosphates,

are found in the urine of 95% of school children.

We already knew that

Glysophoate causes birth defects in humans.

As I noted back in May when Monsanto’s price dropped,

“I think that’s CEO-speak for demand is down, competition is up, and

Monsanto is retrenching in hopes of saving its core glysophate business.”

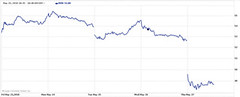

The company’s stock, which rose steadily over several years to peak at

around $140 a share in mid-2008, closed Monday at $47.77, having fallen

about 42 percent since the beginning of the year. Its earnings for the

fiscal year that ended in August, which will be announced Wednesday,

are expected to be well below projections made at the beginning of the

year, and the company has abandoned its profit goal for 2012 as well.

The company’s stock, which rose steadily over several years to peak at

around $140 a share in mid-2008, closed Monday at $47.77, having fallen

about 42 percent since the beginning of the year. Its earnings for the

fiscal year that ended in August, which will be announced Wednesday,

are expected to be well below projections made at the beginning of the

year, and the company has abandoned its profit goal for 2012 as well.

Maybe this is why Monsanto

apparently hired Blackwater, excuse me, Xe, or, rather, its affiliate

Total Intelligence, “to provide operatives to infiltrate activist groups

organizing against the multinational biotech firm.”

But there is more. Sales of Monsanto’s Roundup, the widely used

herbicide, has collapsed this year under an onslaught of low-priced

generics made in China. Weeds are growing resistant to Roundup, dimming

the future of the entire Roundup Ready crop franchise. And the Justice

Department is investigating Monsanto for possible antitrust violations.

But there is more. Sales of Monsanto’s Roundup, the widely used

herbicide, has collapsed this year under an onslaught of low-priced

generics made in China. Weeds are growing resistant to Roundup, dimming

the future of the entire Roundup Ready crop franchise. And the Justice

Department is investigating Monsanto for possible antitrust violations.

But on with the NY Times story:

That’s probably not helped by the news that the best way to profit by GM corn is not to grow it.Now, however, the skeptics also include farmers and investors who were once in Monsanto’s camp.

“My personal view is that they overplayed their hand,” William R. Young, managing director of ChemSpeak, a consultant to investors in the chemical industry, said of Monsanto. “They are going to have to demonstrate to the farmer the advantage of their products.”

Especially when Roundup no longer stops the mutant pigweed which it bred. Instead, plowing the pigweed under in the fall and planting a winter cover crop allows eliminating the pigweed without paying for RoundUp.

Haiti has rejected Monsanto seeds and thus the pesticide poisons that come with them. Maybe the rest of the world is starting to follow.

So sad for Monsanto. So good for the rest of us.

-jsq

Short Link: